Ways To Give

The Windsor Regional Hospital Foundation exists for the sole purpose of supporting Windsor Regional Hospital.

It seeks financial support and sustains its mission to deliver an outstanding care experience driven by a passionate commitment to excellence. The support of generous donors and friends allows for enhancements to patient care.

All gifts are important and meaningful and provide much-needed support. Donations are recognized with a charitable tax receipt and our sincere thanks.

To make a contribution to the Windsor Regional Hospital Foundation, contact:

By Phone:

Please call: (519) 254-5577 Ext. 52449 or Ext. 52004

By Mail:

If you wish to make a donation to Windsor Regional Hospital Foundation by mail, you may send your donation to:

Windsor Regional Hospital Foundation

1995 Lens Avenue,

Windsor, Ontario N8W 1L9

Please make cheques payable to: Windsor Regional Hospital Foundation

If this is a Memoriam Donation, please include the following information:

- name of honoree/loved one

- Name and complete address of next-of-kin (if you would like us to notify them of the donation)

- Specific Fund, if desired, i.e. Women's & Children's, Cardiac, Oncology, Palliative Care, etc.

- Name and complete address of donor

All gifts are recognized with a charitable tax receipt and our sincere thanks.

Online donation

The Windsor Regional Hospital Foundation is committed to assisting donors in structuring their gifts to meet their personal objectives and ensuring the maximum tax credit available. Planned giving, because of its flexibility and tax advantages, is increasingly the giving option of choice. The Foundation welcomes and encourages donations of all kinds: life insurance, bequests, property, cash, securities, memorial donations and gifts-in-kind.

Gifts of cash can be designated for a specific program or project, or they can be unrestricted. Donations without restrictions allow the Hospitals to respond to the most urgent needs.

(Please note that many corporations sponsor matching gift programs in which your employer matches your contribution. Contact your company for more information.) |

| These gifts take many forms - equipment, art, real estate, stocks and bonds. |

| Endowment funds can be directed to the Windsor Regional Hospital Foundation for special projects. Funds are established in perpetuity to meet long-term needs. |

| Often referred to as "deferred gifts" or estate gifts, bequests are specified in a donor's will. |

| A life insurance policy naming the Windsor Regional Hospital Foundation as the owner and beneficiary allows the donor to make a significant future gift to the hospital for only pennies on the dollar and provides substantial tax benefits. |

|

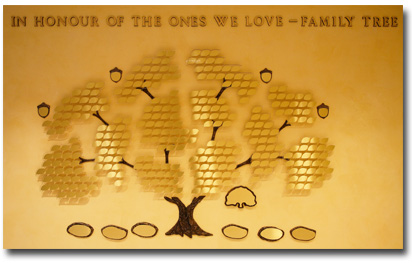

This tree was created by In Honour of the Ones We Love as way for individuals to honour a loved one, show appreciation or mark someone's memory by purchasing a Leaf, Acorn, Rock or Tree. This is a great way for individuals, groups or organizations to support Windsor Regional Hospital Foundation and honour someone special.

Levels of Giving

$1,000 - Leaf

$2,500 - Acorn

$5,000 - Rock

$10,000 - Tree |

|

All gifts are tax-deductible and can be pledged over three to five years.

For more information contact:

Gisele Seguin, Director

(519) 254-5577 x52008

gisele.seguin@wrh.on.ca |

|

Support the Hospital By Shopping!

Gift Cards Order Sheet

We all have to purchase everyday, essential items like food, gas and clothing. Windsor Regional Hospital is launching a program whereby you can support the hospital by shopping for these necessities! We have partnered with Fundscrip, an online fundraising program that allows us to make 2-5% back on every gift card that we purchase.

Over 100 participating retailers like Loblaws, Best Buy, Home Depot and Canadian Tire are included. It doesn't cost anything to participate. Supporters don't have to change their buying habits or purchase anything that you don't need.

You can simply visit the Foundation Office at Met campus or Ouellette Campus.

Our plan is to keep the most popular gift cards in stock so they can be picked up at your convenience. Cash, debit, credit and cheque are all accepted.

We currently carry the following brands of gift cards:

Groceries

- Metro Group/Food Basics

- President's Choice/Zehrs, No Frills, Wholesale Club

- Sobeys/Freshco

Fuel/Gas Cards

Coffee

Restaurants

- Red Lobster

- Subway

- The Keg

- The Ultimate - Swiss Chalet, Harveys, Kelsey's

Local Businesses

- Artisan Grill

- Cotta

- Estetica

- Fred's Farm Fresh

- Kona Sushi

- Mezzo Ristorante

- Over 360

- Spago

- Take 5

Ted Farron's

- Ted Farron's Butcher Shop

- The G.O.A.T.

- Tommy's BBQ

Retailers

- Amazon

- Bath & Body Works

- Best Buy

- Canadian Tire

- Chapter's / Indigo

- Cineplex Odeon

- Dollarama

- Giant Tiger

- Golftown

- Home Depot

- Home Hardware

- iTunes

- Mark's Work Wearhouse

- Sephora

- Shopper's Drug Mart

- Sportchek

- The Bay / Home Outfitters

- Toys R Us

- Walmart

- Winners / Homesense

Other organizations have had tremendous success with this program. With 4,000 Windsor Regional Hospital "family members" we have the opportunity to be very successful. Your friends and family are also eligible to participate in the program. Please assist us in spreading the news and information about this exciting initiative to generate funds for Windsor Regional Hospital.

Any questions about the program can be directed to Sandra Bauer at 519-254-5577 ext.52004, or via email at sandra.bauer02@wrh.on.ca.

|

Memoriam Donations

You can make a donation in memory of a loved one or friend in the following manner:

- online by visiting our Donate Now! section

- by phone using a credit card (519) 254-5577 ext. 52004

- by mail to:

Windsor Regional Hospital Foundation 1995 Lens Avenue, Windsor, Ontario N8W 1L9

Please include the following information:

- Name of honoree/loved one

- Name and complete address of next-of-kin (if you would like us to notify them of the donation)

- Specific Funds, if desired, i.e. Women's & Children's, Cardiac, Oncology, Palliative Care, etc.

- Name and complete address of the donor.

|

Legacy Giving

What is Legacy Giving?

Many people wonder what “planned giving” or “legacy giving” means. Simply put, it’s a way to support the causes you care about through thoughtful financial planning – most commonly through your will — and often includes tax and estate planning benefits.

Leaving a gift in your will is a meaningful way to support Windsor Regional Hospital Foundation and helps ensure the well-being of our community for generations to come.

How to Leave a Gift in Your Will

Including a gift in your will is easy. It’s a straightforward way to support Windsor Regional Hospital and it also allows you to maintain control over your assets for the rest of your life.

Many people who choose to leave a gift to charity in their will make one of the following common types of legacy gifts:

Residual gift: A residual gift allows you to designate whatever remains of your estate after debts, taxes, expenses, and all other gifts to your beneficiaries (including family and friends) have been fulfilled. You may prefer this option if you’re unsure of the total size of your estate or you’re interested in dividing your total assets among a few beneficiaries.

Specific purpose gift: A specific purpose gift permits you to direct your gift toward a cause of your choice. Please keep in mind that your gift may be realized many, many years from now and some hospital departments or programs may no longer be operating. We recommend that you use wording that is as broad as possible and we can assist you with that.

Key Information You Need

If you choose to leave a gift to Windsor Regional Hospital Foundation in your will, here are the two key pieces of information you will need when you visit your lawyer:

Legal name and address:

Windsor Regional Hospital Foundation

1995 Lens Avenue

Windsor, ON N8W 1L9

Charitable registration number: 11930 0275 RR0001

How We Thank You

When you let us know that you have included Windsor Regional Hospital Foundation in your will, you become a member of the Life Legacy Society, a special group of like-minded donors who are committed to making future gifts to Windsor Regional Hospital Foundation.

Members of the Life Legacy Society receive:

- Welcome letter to our Life Legacy Society

- Recognition on our Life Legacy Donor Wall at both campuses (and future sites)

- An exclusive Legacy Giving recognition item as a symbol of our gratitude for your legacy gift

- Invitations to special events, including our annual Life Legacy Society appreciation event

- Newsletters with real stories from the patients and staff you are helping by supporting Windsor Regional Hospital Foundation

Other Legacy Giving Options

Apart from leaving a gift in your will, you can make a legacy gift through stocks, RRSPs and more. For information on other forms of legacy giving, contact our team and we would be happy to review these options with you.

FOR MORE INFORMATION, PLEASE CONTACT:

Gisele Seguin

Phone: 519-987-3160

Email: Gisele.Seguin@wrh.on.ca

|

We are grateful to the following individuals for allowing us to share their stories about their legacy gifts. If you are interested in sharing your story that will provide inspiration for others, please contact Gisele Seguin at 519-254-5577 ext. 52008 or Gisele.Seguin@wrh.on.ca.

ELIZABETH PHILLIP

Elizabeth Phillip has lived in Windsor her entire life. She understands the importance of building a strong community and supporting organizations that benefit our friends and family. As such, Elizabeth has named Windsor Regional Hospital Foundation as a beneficiary in her estate plans.

A Chrysler retiree, Elizabeth has been a loyal donor to several charitable organizations. However, she realized that by leaving a bequest she would have the opportunity to make an even greater impact to an organization that she feels passionate about.

Over the years Elizabeth has been both a patient and visitor to Windsor Regional Hospital. She was a loyal companion to her best friend Jean and her sister Mary as they dealt with devastating illnesses that ultimately ended their lives. Through it all, Elizabeth was always impressed by the caliber of care that was offered at Windsor Regional Hospital.

"It is comforting to know that when situations arise that require medical attention there is a first-rate hospital in our own community to meet these needs. My bequest to Windsor Regional Hospital will ensure that funds stay in this community to benefit future generations."

In Leaving A Legacy to Windsor Regional Hospital, Elizabeth’s gift will be used to fund vital equipment and services ensuring that "Outstanding Care - No Exceptions!" is a reality for the future.

KAREN MCCULLOUGH

Giving Starts at "Home"

For twenty-four years Karen McCullough has been a valued member of the Windsor Regional Hospital family. Karen's passion and dedication to this organization is evident from the various roles she has held over the years including; Staff Education Coordinator at Riverview Hospital before the merger, Manager of Education, Director of Learning Resources and Director responsible for program transfers. Today Karen applies her leadership and skills as Vice-President, Acute Care Services/Chief Nursing Executive.

It is not surprising to anyone who knows Karen to find out that she wanted to ensure that outstanding care continues to be available for residents of Windsor and Essex County long after she is gone. As such, Karen chose to set up a life insurance policy that names Windsor Regional Hospital as the beneficiary. This legacy gift option not only provides for the future, it also benefits Karen as well since she can claim the premiums she pays on her income taxes annually. Furthermore, by establishing a legacy gift to Windsor Regional Hospital, Karen is able to make a significant gift to an organization she is passionate about.

Many individuals favour this legacy gift option because of its simplicity and the fact that it allows some tax relief immediately. Anyone who is interested in setting up a charitable life insurance policy simply has to meet with a life insurance provider. Once the paperwork is completed the life insurance provider will inform the charity who will then ensure that the proper tax receipt is issued to the individual on an annual basis. Most importantly, the charity will receive a significant gift in the future. Often times this gift is much more substantial than a gift that one can make while they're alive.

In the case of Windsor Regional Hospital, legacy gifts have an enormous impact. To keep up with the latest technologies and medical advances there is always an extensive equipment list along with capital needs. Currently, Windsor Regional Hospital is involved in a $122 million renovation project that will drastically transform its Western campus that provides care to rehabilitation, mental health and complex continuing care patients. Already, a couple of legacy gifts have made a tremendous impact by contributing to this project that will benefit the entire community.

These are legacy gifts left by people like Karen who believe in giving back to their community. "Windsor Regional Hospital is an organization that I take great pride in being a part of. It stands for quality, safety and a commitment to caring for our patients and the community at large. I want to be sure that I have done all that I can to keep the hospital's vision moving forward now and into the future."

|